Table of Content

- Where UK vehicle manufacturing stands today

- How the UK compares with continental Europe

- Why volume matters for the automotive industry

- Electrification is changing the supply chain

- Why new factories are essential to UK vehicle production growth

- Why new entrants are back in focus

- What this means for B2B suppliers and partners

Where UK vehicle manufacturing stands today

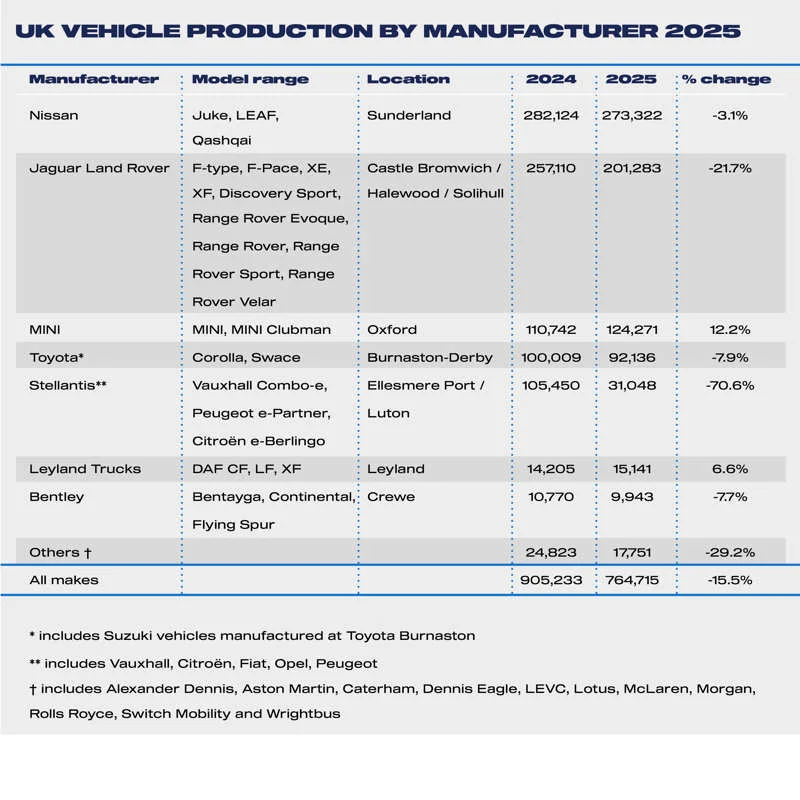

Right now, UK vehicle production is below the levels the industry has set for the future, and that gap shows up clearly in recent data and trends.

In 2025, the total number of cars and vans built in the UK fell sharply compared with the year before, reaching one of the lowest annual outputs since the early 1950s and well below volumes seen a decade ago.

Production slipped by around 15%, leaving output in the mid-700,000s, even as some months saw small upticks in electric vehicle builds.

The drop comes from a combination of issues facing UK manufacturers. Changes in global trade, including tariffs and weaker export demand, have reduced orders. A major cyber-attack at one of the UK’s largest carmakers also caused production to stop temporarily, slowing output further.

At the same time, commercial vehicle production has fallen in some areas as companies update older plants and shift their production plans.

Passenger car lines are still running, and electric and hybrid vehicles now make up a larger share of output in some months. However, overall production remains too low to give suppliers and investors the stable demand they are looking for.

How the UK compares with continental Europe

When you zoom out and look at what’s happening across continental Europe, the UK’s production challenge becomes easier to understand.

Many European car makers are facing the same pressures around costs, energy, and electrification. The difference is that, in several EU countries, factories are still running closer to their normal capacity.

That comes down to structure as much as strategy. In parts of Europe, automotive production is spread across more sites, often with newer plants that were designed to scale more easily.

In places such as Germany, Spain, and parts of Central Europe, automotive capacity is more evenly spread across multiple sites, which helps absorb short term disruptions and keeps volumes relatively stable.

When one factory slows down or retools, others can keep volumes moving. For suppliers, that usually means more consistent demand and fewer sudden stops. For investors, it makes planning feel less like a gamble.

In the UK, the picture is a bit more fragile. With fewer large plants and an older production base, changes in output tend to ripple through the system more quickly.

When volumes dip, suppliers feel it almost immediately, whether that is in reduced orders, delayed projects, or paused investment decisions across the industrial supply chain UK.

This doesn’t mean the UK is out of the race. But it does explain why upcoming decisions matter so much. Across Europe, manufacturers are choosing where to place new electric vehicle plants, battery sites, and supporting infrastructure.

How the UK compares with its European neighbours will play a big role in whether future automotive manufacturing investment lands locally or goes elsewhere.

Why volume matters for the automotive industry

In automotive manufacturing, volume is what keeps everything moving. When UK vehicle production runs at scale, factories tend to work more smoothly, fixed costs are easier to absorb, and the wider automotive manufacturing ecosystem stays competitive.

Strong volumes also help manufacturers stay in step with global production standards and make long-term commitments to local operations more realistic.

At a broader industry level, volume brings a sense of stability. Consistent output supports clearer pricing and makes long term planning less uncertain across the sector.

When volumes drop or stay too low for too long, cost pressure builds and investment decisions become harder to justify, which can gradually weaken the industrial base.

This is why production scale is still closely tied to investment. Predictable volumes often give manufacturers the confidence to invest, whether that is in new capacity, new models, or wider industrial projects that keep supply chains active and competitive over time.

Electrification is changing the supply chain

Electrification is becoming a bigger part of UK vehicle production, even as overall volumes remain low.

In 2025, electric and hybrid vehicles accounted for a growing share of what UK factories produced, with more than four in ten vehicles built using electrified powertrains.

As production changes, so does demand across the B2B automotive supply chain. Electric vehicles require different components and systems, including batteries, power electronics, thermal management and software.

EV platforms also change how factories are designed and operated. Producing electric vehicles often requires new layouts, upgraded power supply and different assembly processes compared with traditional engines.

Why new factories are essential to UK vehicle production growth

Reaching the next phase of growth will depend on adding new manufacturing capacity, not just improving what already exists. Without new factories, UK vehicle production cannot reach 1.3 million units, regardless of efficiency improvements at existing plants.

Current facilities were built for lower output and different vehicle generations, which makes it difficult to scale production fast enough to meet long term goals. UK automotive capacity was designed for a different era of vehicle production and cannot scale quickly enough on its own.

Modern vehicle factories are designed around flexibility and scale. Large new sites can support multiple models, higher automation, and integrated battery and energy systems from day one.

In practical terms, that kind of expansion would mean steady, long term demand right across the B2B automotive supply chain, from equipment and construction to logistics and industrial services.

Why new entrants are back in focus

Meeting future production goals is unlikely to come only from companies already operating in the UK. Many established manufacturers are focused on optimising existing sites, managing costs or restructuring their global footprints.

While this can stabilise output, it limits how much additional growth they can deliver on their own within current capacity.

This is why the focus is increasingly turning to global electric vehicle manufacturers that are expanding production. Many are rolling out new plants across multiple regions and looking for locations that align with their long-term plans.

For the UK, attracting this kind of inward investment automotive could add fresh capacity and strengthen the wider automotive manufacturing ecosystem.

Producing vehicles closer to where they are sold also matters more than it used to. Shorter supply chains reduce logistics costs, lower exposure to trade friction, and improve delivery times.

What this means for B2B suppliers and partners

For B2B professionals, the real issue is not the target itself, but the structural changes needed to make it achievable.

Reaching 1.3 million vehicles a year would require new manufacturing capacity, not just incremental efficiency gains. That means new factories, fresh automotive manufacturing investment, and changes across the industrial supply chain UK, with clear implications for suppliers, service providers, and partners across the B2B automotive supply chain.

If vehicle production increases, the effects are felt far beyond the assembly line. Demand tends to rise across components, engineering services, construction, logistics, site operations, and the everyday infrastructure that keeps manufacturing running.

Well before anything is announced publicly, early planning often shows up in the form of RFQs used to gauge supplier capacity and explore potential partnerships.

Timing also matters more than it might seem. Suppliers that engage early are usually in a stronger position once decisions are made. Keeping an eye on where production could expand, and on what manufacturers are likely to need next, helps companies move from reacting to changes to planning ahead.

For international B2B firms, the UK is increasingly seen as part of a wider manufacturing network rather than a market on its own. What matters most is how straightforward it is to enter, scale, and build dependable local partnerships. For businesses ready to grow alongside new production capacity, the UK is still very much worth watching.

Conclusion

The next ten years will be decisive for the UK automotive industry. Strategies and targets help define the vision. Today’s decisions will determine whether production grows or remains flat.

If new capacity fails to come online, the risk is fairly straightforward. The gap between UK production targets and actual output will only close if new manufacturing capacity is added.

Without new factories, the gap between ambition and reality will persist and investment will simply go elsewhere. It also becomes much harder for the industry to scale and for supply chains to grow alongside it.

For B2B decision makers, this is a moment worth watching closely. Early signals around new sites, investment choices, and long-term commitments often reveal where momentum is starting to build.

Read more about automotive supply chains, industrial investment, and European supplier strategies at Inside Business: the B2B blog from europages.