Overview

- What Exactly Is Cultivated Meat?

- Is Cultivated Meat Healthy? What Science Says

- Where Europe Stands, Country by Country

- Why Consumers Are Ready to Try Cultivated Meat

- What This Means for B2B Procurement and Product Strategy

1. What Exactly Is Cultivated Meat?

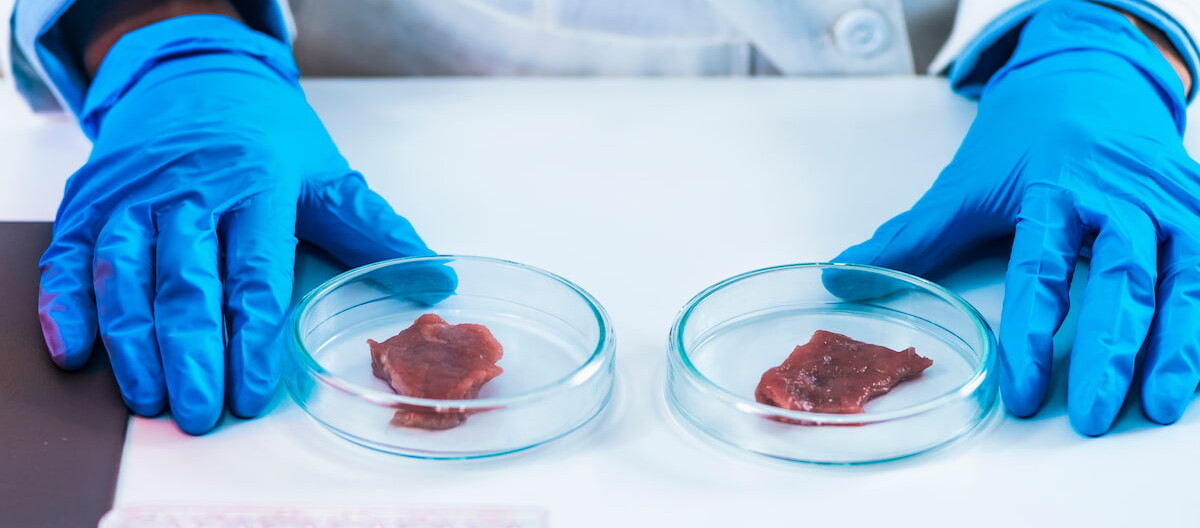

Cultivated meat, also called lab-grown or cell-based meat, is real meat. But instead of raising animals, companies harvest a small number of animal cells and grow them in controlled environments using nutrients, warmth, and oxygen.

The result is meat that looks, tastes, and cooks like the traditional version, but with a fraction of the environmental impact.

The process avoids livestock farming, reduces land and water use, and eliminates the need for antibiotics in the supply chain.

2. Is Cultivated Meat Healthy? What Science Says

Scientific studies worldwide confirm that cultivated meat offers comparable protein, fat, and micronutrient levels to conventional meat.

Cultivated meat could offer equal or even improved nutritional value compared to traditional meat, depending on how it's developed. Here’s why:

Customisable Nutrition

- Fat levels can be adjusted to reduce unhealthy saturated fats.

- Products can be enriched with healthy fats like omega-3s.

- Free from antibiotics and contaminants commonly found in conventional meat supply chains.

No Antibiotics, No Hormones

- Grown in sterile, controlled environments without antibiotics or growth hormones.

- Eliminates health concerns linked to antibiotic resistance in traditional livestock farming.

Lower Risk of Foodborne Illness

- Cultivated meat carries a significantly lower risk of pathogens like Salmonella and E. coli.

- Clean production processes reduce exposure to common sources of meat-related food poisoning.

- Since cultivated meat is still new, long-term population studies don’t yet exist.

However, because it’s biologically the same as traditional meat, most scientists and regulators currently consider it a safe and nutritious food, provided that the production processes meet rigorous food safety standards.

Building strong partnerships with reliable food suppliers will be essential to ensure consistent quality and consumer trust as the market develops.

3. Where Europe Stands, Country by Country

Cultivated meat could be on European shelves within the next two years. Momentum is building fast, with Czechia and the Netherlands emerging as early movers. In fact, the Netherlands is already leading in research and has allowed early-stage tastings under controlled conditions.

The European Food Safety Authority (EFSA) and other regulatory bodies in Europe are conducting thorough evaluations to ensure consumer safety before any cultivated meat product is approved for the market.

The pace is likely to accelerate as Singapore and the US have set international precedents, making the pathway clearer for Europe. However, the future market could be fragmented.

Some European countries may move quickly to embrace cultivated meat, while others could impose restrictions or outright bans, creating an uneven market across the region.

| Country | Position on Cultivated Meat | Status / Remarks |

| Hungary | Banned | Recently passed legislation prohibiting production and sale.

|

| Italy | Restrictive | Proposed ban to protect traditional food heritage.

|

| Czechia | Open | Active discussions; potential early adopter.

|

| Netherlands | Supportive | Leading research; controlled tastings are already allowed.

|

| France | Cautious but Engaged | Ongoing regulatory talks; no clear approval pathway yet.

|

| Denmark | Proactive | Government support focused mainly on plant-based proteins.

|

| Spain | Neutral / Exploratory | No formal stance yet; discussions are ongoing.

|

| Singapore & USA | Approved (Reference Markets) | Lab-grown salmon and chicken are already on sale. |

4. Why Consumers Are Ready to Try Cultivated Meat

Consumer interest in alternative proteins is booming. Nearly 42% of Europeans across 13 countries have tried plant-based proteins, pulses, or other meat alternatives in the past two years.

Young consumers are especially curious. In Germany, 82% of people aged 18–24 said they would eat cultivated meat. In France, the figure is lower, but the younger generation remains the key driver for future demand.

Supermarkets are already adjusting. Leading grocery retailers in countries like the UK, Germany, and the Netherlands are expanding their plant-based private labels, and cultivated meat is expected to follow a similar trajectory as demand rises.

Cultivated meat could quickly move from niche to mainstream, especially among health-conscious and sustainability-minded shoppers.

5. What This Means for B2B Procurement and Product Strategy

- Supply Chains Will Change: Cultivated meat will bring new suppliers, technologies, and logistics requirements. Quality controls will need updating, especially around storage, transport, and traceability.

- Portfolios Will Diversify: Adding cultivated meat can provide a competitive edge for businesses focused on sustainability and innovation.

- Compliance Will Be Key: Labeling and classification rules are expected to vary between EU countries. Staying ahead of regulatory changes will be crucial.

- Contracts and Pricing May Be Complex: Early cultivated meat products will likely be limited in volume and carry premium prices. Buyers will need flexible contracts and new pricing strategies to handle uncertainty. However, forming early partnerships might secure better terms as the market develops.

Conclusion

Cultivated meat is rapidly becoming a real option for European B2Bs and SMEs.

The next two years will be pivotal for this emerging food trend. Companies that explore B2B partnerships now may be among the first to offer these innovative products and gain an edge in the growing sustainability race.

For more articles about food trends and sustainability, read the following on the europages Inside Business blog:

Edible Food Packaging: A Sustainable Future?

Fermented Foods: Benefits, Trends & Sustainability

Foodceuticals: The Future of Food & Health

End of GMO-Free Agriculture? Farmers Protests and EU Reform

10 Trends Reshaping the Supplier of Frozen Food Industry in 2025