Table of Contents

- Popular Xmas Markets and Why They Matter for B2Bs

- How Christmas Markets Help B2B Businesses

- Christmas Market Overview by Country (Running Timetable)

- Popular Products to Watch in 2025

- Logistics and Stock Management for Seasonal Products

- FAQ

Popular Xmas Markets and Why They Matter for B2Bs

Eurostat estimates that Europe receives over 250 million seasonal tourism visits between late November and early January. This surge creates fast-moving commercial cycles for suppliers and distributors.

For B2B decision makers, the key question is how these markets influence sourcing and what this means for packaging, logistics and manufacturing teams preparing for next year.

The importance of Christmas markets becomes clearer when considering their origins and how they grew into major drivers of winter demand. Their growth, rising visitor numbers and changing product preferences guide how suppliers prepare for the season.

The evolving purpose of Christmas markets

Christmas markets began in Central Europe several centuries ago as simple winter gatherings where craftsmen sold woodwork, wool textiles and seasonal foods. What started as a practical way for communities to prepare for the colder months gradually grew into a cherished cultural tradition. Villages added music and lanterns, towns expanded the stalls and by the nineteenth century these markets had become a defining part of the holiday season.

Today they are major seasonal events supported by municipalities, tourism boards and cultural organisations. The best Christmas markets in Europe attract millions of visitors and generate significant activity for regional economies. Behind every decorated square lies a coordinated network of food producers, packaging specialists, logistics providers and freight partners ensuring that vendors remain stocked through the busiest weeks of the year.

Details of Christmas markets by visitors

Visitor data helps suppliers assess demand. The following ranking is based on annual attendance for 2024. It offers an overview that supports forecasting and Request for Quotes planning for both local and international suppliers.

When a Christmas market welcomes two to three million visitors, the ripple effect on procurement becomes significant. Food vendors, packaging suppliers and freight operators must anticipate millions of units of cups, boxes and gift bags moving through the stalls.

Such volume turns replenishment into a carefully choreographed operation, where stable Christmas delivery schedules become essential to keeping the market running smoothly.

Against this wider market context, it becomes clear why some destinations rise to the top, standing out for both their atmosphere and the strong organisation behind them.

The following list highlights the ten best Christmas markets in Europe, each distinguished by its visitor volume, commercial activity and relevance for suppliers preparing for the 2025 season.

1. Cologne, Germany — Cologne Cathedral Market

≈ 4–5 million visitors

Famous for its cathedral backdrop, extensive stall variety and strong German Christmas traditions.

2. Vienna, Austria — Rathausplatz

≈ 3–3.5 million visitors

One of the largest Christmas markets in Europe, known for imperial scenery, orchestral performances and a wide craft offering.

3. London, UK — Hyde Park Winter Wonderland

≈ 2.5–3.0 million visitors

The UK’s largest festive event, combining a market with attractions, shows and large commercial zones.

4. Brussels, Belgium — Winter Wonders

≈ 2.5 million visitors

A large city-wide event combining markets, performances, international foods and light shows.

5. Edinburgh, UK — Edinburgh Christmas Market

≈ 2.3 million visitors

One of the UK’s most visited Christmas experiences, stretching through central Edinburgh with strong seasonal programming.

6. Strasbourg, France — Christkindelsmärik

≈ 2–2.5 million visitors

One of Europe’s oldest markets, renowned for its Franco-German heritage and its “Great Christmas Tree.”

7. Prague, Czech Republic — Old Town Square

≈ 2 million visitors

Highly atmospheric, with Gothic architecture, a large tree and popular Czech sweet and savoury street foods.

8. Nuremberg, Germany — Christkindlesmarkt

≈ 2 million visitors across all sites

One of the most traditional and curated markets, famous for its Christkind opening ceremony.

9. Budapest, Hungary — Basilica Market

≈ 1.5 million visitors

Known for affordability, spectacular light shows and high-quality handmade crafts.

10. Copenhagen, Denmark — Tivoli Gardens Christmas

≈ 1 million visitors

Set inside a historic amusement park, offering rides, lakefront decorations and Danish design.

Honourable mentions:

These markets stand out for their strong regional influence, reliable visitor volumes and well-developed vendor ecosystems, making them notable contenders just outside the top 10.

11. Barcelona, Spain — Fira de Santa Llúcia

≈ 0.8–1 million visitors

Barcelona’s oldest Christmas market, located beside the cathedral. Known for its nativity figures, Catalan craft stalls, seasonal greenery and strong local artisan presence.

12. Bolzano, Italy — Mercatino di Natale (Bolzano Christmas Market)

≈ 0.5–0.7 million visitors

Italy’s most famous Alpine Christmas market, celebrated for its wooden chalets, high quality regional products, traditional Tyrolean crafts and premium gift packaging.

Products sold across major European markets

The mix of products found at Christmas markets tells a story of tradition meeting changing consumer expectations.

Visitors gravitate toward items that feel authentic, easy to gift and simple to carry home, and this behaviour quietly directs what retailers choose to stock. Behind the scenes, suppliers must anticipate these patterns, adjusting production and inventory so the magic on the stalls never runs out.

Common products include:

- Christmas lights and lighting accessories

- Wrapping paper and bags for wrapping paper

- Food and beverages requiring heat resistant or eco-friendly packaging

- Decorations sold under Xmas decorations sale cycles

- Gift bundles, personalised Christmas cards packs and seasonal stationery

- Boxes such as Xmas hamper boxes or Christmas eve box products

- Woodwork

These preferences influence supplier decisions on materials, packaging and replenishment. In busy markets, where items sell quickly, suppliers prepare for demand well before the first stall opens.

How Christmas Markets 2025 Help B2B Businesses

Christmas markets help drive not only the B2C economy but also a wide B2B ecosystem that powers the season behind the scenes. Eurostat reports that seasonal retail accounts for more than 20% of Q4 consumer spending in many European countries. This surge creates opportunities for packaging manufacturers, freight companies, last-mile carriers, food producers and craft suppliers.

Some businesses generate direct revenue at the stalls, while others benefit indirectly by supplying goods through B2B channels. Along the way, Christmas markets amplify brand visibility for regional producers, turning festive demand into a broader economic engine.

Do Christmas markets generate revenue or just influence image?

Christmas markets create a strong economic boost. The 2024 Bath Christmas Market survey reports shows that visitors spend around £31.31 (≈ €36) per person per day, with even more spent elsewhere in the city.

In larger markets like Cologne or Vienna, this buying power leads to fast stock turnover and millions in seasonal revenue, supported by B2B suppliers who keep stalls stocked throughout the season.

Smaller regional markets generate less income, but they offer producers a useful place to test packaging, measure interest in seasonal products and connect with local buyers. For many B2B companies, these markets are both a sales opportunity and a live showcase.

Overall, Christmas markets drive short-term sales and strengthen long-term brand visibility, making them important platforms for European suppliers preparing for seasonal demand.

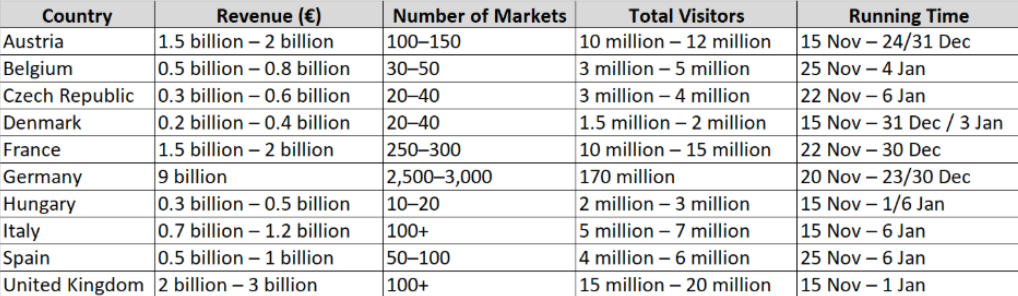

Christmas Market Overview by Country

This table shows how Christmas markets differ across Europe, helping international suppliers plan stock, deliveries and request for quotations for the peak season.

Understanding what Christmas delivery means for B2B operations

Rising demand for fast Christmas delivery puts pressure on suppliers, distributors and logistics partners. What looks quick to shoppers depends on accurate stock, faster fulfilment and good coordination with freight companies. Across Europe, demand for festive goods grows from mid-November, so manufacturers and wholesalers prepare stock earlier and book shipment slots ahead of time.

Freight companies feel the impact first as volumes rise. Major markets often need daily restocking, and B2B suppliers focus on keeping retailers and stall operators stocked during the busiest weeks.

Retailers expect from their B2B suppliers:

- Reliable delivery windows, even during peak-season congestion

- Packaging that supports seasonal branding, showcases christmas wrapping paper, and allows fast shelf presentation

- Protective materials for fragile festive items

- Sustainable packaging options that meet corporate responsibility goals

- Identifying high demand products

Demand forecasting becomes essential when the season’s rhythm grows faster each day. The most purchased items include Christmas wrapping paper, Christmas lights, candles, textiles and food gifts.

A business selling personalised Christmas cards packs might require thousands of envelopes and cardboard sleeves. Packaging companies supplying Xmas decorations sale cycles often produce items in bulk between July and October.

Many suppliers and logistics providers report an internal uptick in RFQ and order activity beginning in late summer, peaking in Q4 as markets gear up for the holiday season

.

Popular Products in Xmas Markets to Watch in 2025: From handcrafted gifts to xmas hamper boxes

Seasonal markets play a quiet but important role in guiding product innovation across packaging, logistics and food industries. Interest in eco-friendly materials, premium gifting and personalised designs is already shaping how European suppliers plan their portfolios for next year.

Eurostat notes an 18% rise in seasonal packaging demand in 2024, with early signs suggesting continued growth. On the supplier database, buyers now request samples months ahead, since strong shelf appeal often decides who wins the best placements once the season starts.

Sustainable Packaging That Sells: Eco Friendly Wrapping Paper, Reusable Gift Bags, Gift Bundles and Smart Display Solutions

Eco-friendly wrapping paper is a major trend in 2025 as retailers move away from laminated, hard-to-recycle materials. Reusable gift bags are also becoming popular with younger shoppers and international visitors. Suppliers offering FSC-certified paper, natural fibres or durable reusable formats benefit as sustainability becomes a key part of seasonal buying.

- Key areas of growing demand include:

- Recycled kraft wrapping paper

- Fabric reusable gift bags

- Compostable clear sleeves

- Reusable boxes

These options help businesses meet OECD environmental goals and stay competitive as more customers choose greener products. Easy-to-gift packaging performs especially well. Gift bundles sell quickly, and personalised Christmas card packs remain popular.

Premium gift packaging options: Xmas hamper boxes and sock fillers

Premium products are becoming more popular as travellers look for gifts that are easy to carry home. Retailers increasingly order Christmas hamper boxes for artisanal foods , wines or cosmetics because they look attractive and protect the products well. This format also helps businesses introduce higher price points. Smaller accessories sold as stocking fillers are often packed in sturdy mini boxes that support high-volume sales and make logistics easier. Freight operators also benefit, since compact packaging saves space during transport.

Suppliers offering these formats on B2B marketplaces often see RFQ activity start as early as June and continue into September, giving them time to prepare for the peak season. International suppliers of rigid board or foldable cardboard packaging often grow the fastest as demand for premium, transport-friendly formats increase.

Logistics and Stock Management for Seasonal Products and Christmas Delivery

Christmas markets create strong short-term demand, which puts pressure on the supply chain. Stall operators have little storage space, so logistics teams must keep stock moving constantly.

Eurostat data shows that seasonal transport activity rises by nearly 30% across central Europe in November and December, creating a tight delivery window. International suppliers rely on trusted partners to keep Christmas wrapping paper, decorations and lights moving, with packaging companies and freight operators working together to avoid delays and deliver on time.

Managing bulky and fragile stock: wrapping paper, decorations and Christmas lights

Christmas wrapping paper is harder to handle than it seems. Its long, round shape makes it bulky, and suppliers need strong, tear-resistant bags to move it safely. Decorations and Christmas lights add more challenges because they are fragile and need reinforced packaging such as dividers or corrugated inserts to prevent damage. Stock needs careful storage to prevent humidity from weakening paper and dust from damaging electrical parts.

- Successful inventory management depends on:

- Pallet optimisation to cut freight costs

- Protective cartons for delicate lighting products

- Adjustable shelving for mixed seasonal stock

- Accurate stock tracking through B2B app systems

For businesses working with international suppliers, these steps become even more important. Coordinating shipments across multiple countries help keep supply steady in different markets, especially when demand peaks at the same time in several regions.

Fast Christmas delivery and storage solutions for seasonal sellers

Fast Christmas delivery is now essential for seasonal sellers as retailers ask for quicker restocking. Freight operators use regional hubs to shorten the last mile, and suppliers of Christmas Eve box items items or hamper boxes prepare goods early to speed up dispatch. Temperature-sensitive products like confectionery add extra challenges and need insulated containers to stay in good condition during transport.

Storage solutions include:

- Short-term modular warehouse leasing

- Shared logistics between stall operators

- Automated sorting systems for large markets

- Cross-docking to reduce handling time

Research supports these improvements. A 2025 study in the European Journal of Computer Science and Information Technology found that companies using IoT-based real-time visibility had 23% fewer stock-outs, 19% lower transport costs and a 17% rise in perfect order fulfilment. For many B2B teams, this technology provides the visibility needed to keep products moving smoothly during peak demand.

FAQ

Why are Christmas markets important for B2B suppliers?

They create a fast spike in demand for packaging, food items, decorations and logistics. Eurostat says seasonal retail makes up over 20% of Q4 spending, giving suppliers a strong period for RFQs.

Which products are most profitable?

Eco-friendly wrapping paper, Christmas lights, gift bundles, hamper boxes and personalised card packs. In big markets, premium packaging and gift sets generate 30–40% of seasonal revenue.

How can businesses prepare for Christmas delivery?

Plan stock early, coordinate with freight partners and track expected volumes. Many suppliers see Christmas delivery requests rise 25–40% between mid-November and mid-December.

Why does Christmas clearance matter?

It shows what sold and what didn’t, helping improve next year’s forecasts. Small changes can cut overstock by 10–20%.

Conclusion

Christmas markets 2025 create an economic impact that goes far beyond tourism. They shape how European suppliers plan production, manage logistics and prepare for demand in wrapping paper, decorations and premium packaging. Clearance results also show how shoppers behave, while growing interest in eco-friendly materials inspires new ideas in sustainable packaging.

For B2B suppliers, these markets increase visibility, attract new buyers and support steady RFQ activity. As tourism rises, the companies that prepare early are best positioned to benefit from the season’s momentum.

Read more about upcoming sourcing trends, peak-season logistics and European supplier strategies at Inside Business: The B2B blog from Europages.