Table of Contents

- What Is the EU-Mercosur Trade Deal?

- The Current State of the EU-Mercosur Deal

- Parliamentary Approval Remains Uncertain

- What This Means for B2B Planning

- Economic Expectations Versus Reality

- Which B2B Sectors Stand to Gain or Lose

- Farmers Remain Firmly Opposed

- Regulatory Differences Still Matter for B2B Trade

- Strategic Stakes Continue to Rise

What is the EU-Mercosur Trade Deal?

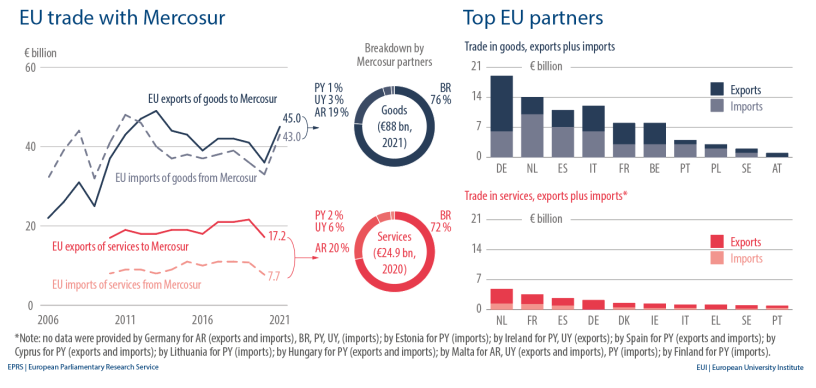

Mercosur has long been seen as a distant but for many European B2B companies promising market. Mercosur is a South American trade bloc that includes Argentina, Brazil, Paraguay, and Uruguay.

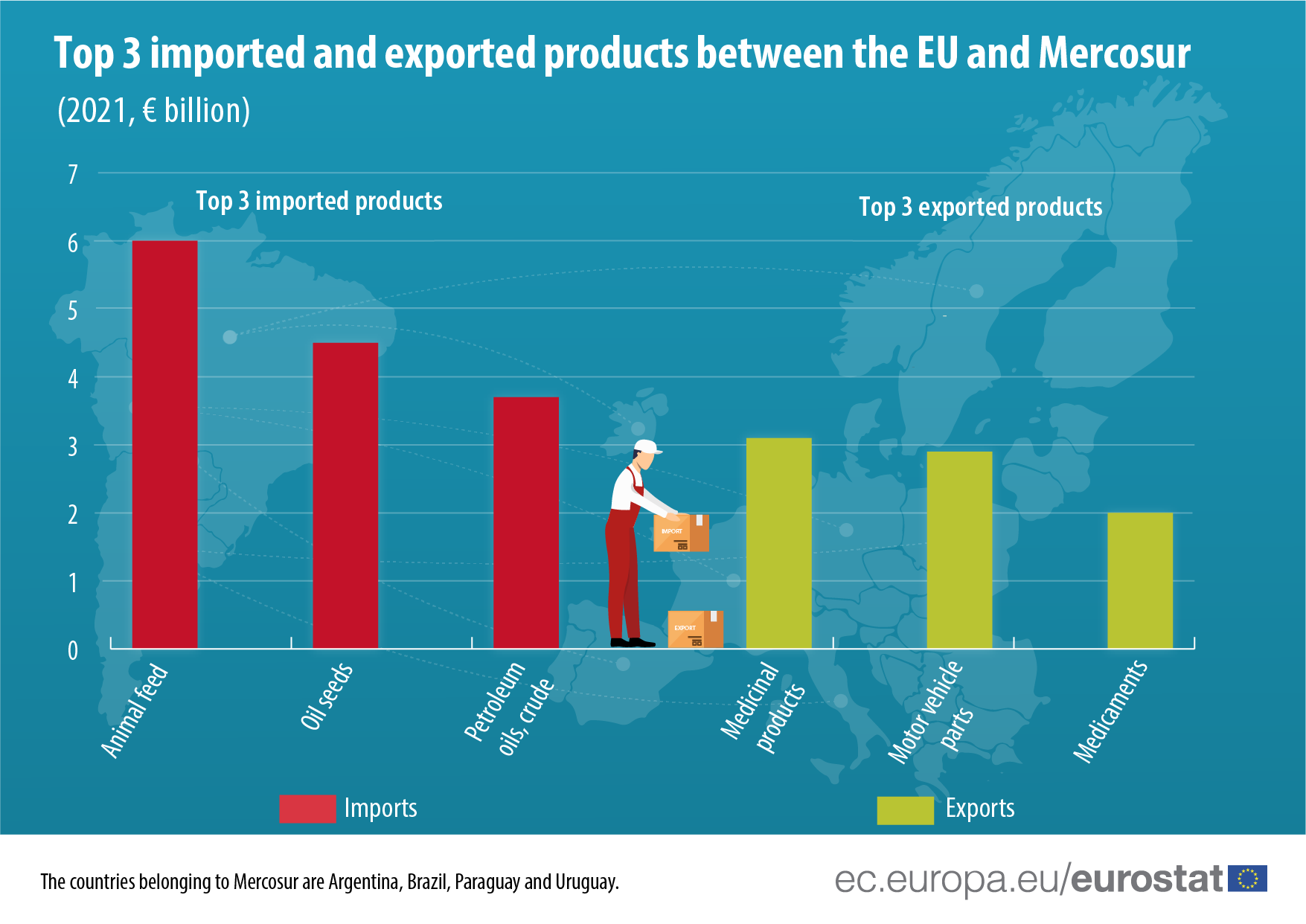

These Mercosur countries already trade extensively with Europe, exporting agricultural goods and raw materials while importing European machinery, vehicles, and pharmaceutical products.

Until now, this trade has often been shaped by high tariffs, complex rules, and political uncertainty. The EU-Mercosur trade agreement is meant to change that by setting up a single free trade agreement between the EU and the South American trade bloc.

If approved, it could make trade more predictable, lower automotive tariffs, support pharmaceutical exports, and give B2B companies clearer conditions for working with Brazilian exports and other regional suppliers.

The Current State of the EU-Mercosur Deal

After more than 25 years of international trade negotiations, the EU-Mercosur trade agreement has reached an important turning point. On January 9, 2026, EU member states approved the deal by a 21-5 vote, with Belgium abstaining. The European Commission formally signed the EU-Mercosur trade agreement in Paraguay on January 17, marking the end of negotiations but not the ratification process.

If the process moves forward, the free trade agreement would create the largest free trade zone in the world, linking Europe with the Mercosur countries and covering more than 700 million consumers. For B2B businesses, this could mean easier market access, lower automotive tariffs, and new opportunities for pharmaceutical exports and industrial trade with the South American trade bloc.

At the same time, several key issues still need to be resolved. Parliamentary approval is still required, and political resistance continues in several EU countries. Ongoing European farmers' protests, discussions around safeguard measures, and broader EU trade policy debates mean that companies cannot yet rely on the agreement when making long-term commercial decisions.

For European B2B players, the question is no longer whether the EU Mercosur trade deal exists, but whether it will bring clear and predictable trading conditions in the months ahead.

Parliamentary Approval Remains Uncertain

The signing of the EU-Mercosur trade deal does not mean it is approved. The agreement still needs parliamentary approval from the European Parliament and could also be reviewed by the European Court of Justice to ensure it complies with EU law.

Opposition comes from across the political spectrum. Green and left-wing MEPs have raised concerns about safeguard measures that could affect Brazilian exports and other trade flows, while far-right parties and parts of the centrist bloc remain divided. As a result, the outcome of the vote is hard to predict.

EU officials have confirmed that the deal cannot be applied, even temporarily, until parliamentary approval is granted. This has slowed expectations in countries such as Germany and Spain, which had hoped the agreement could move quickly in response to US-China competition and growing Chinese influence in South America.

Even if approved by Parliament, the deal would still face a long national ratification process, adding further delays.

What This Means for B2B Planning

For B2B businesses, uncertainty around the EU-Mercosur trade deal makes planning harder. Even if tariffs are expected to fall, companies cannot yet act as if this is guaranteed. Until parliamentary approval is given, current trade rules remain in place.

For many companies, this means:

- Contracts cannot be priced on future tariffs: Automotive tariffs and other duties still apply, so price assumptions remain risky.

- Long-term agreements carry higher risk: Expected cost savings may not happen if the deal is delayed or blocked.

- Sourcing decisions are cautious: Businesses are careful about committing to new suppliers in the Mercosur countries.

- Logistics and investment plans are delayed: Expansion linked to the South American trade bloc is often put on hold.

- Flexibility is a priority: Companies are keeping alternative suppliers and avoiding rigid contracts.

For now, most B2B businesses are keeping a close eye on the parliamentary approval process before taking any decisions tied to the EU-Mercosur trade deal.

Economic Expectations Versus Reality

Supporters of the free trade agreement highlight the size of the EU-Mercosur trade deal and its potential benefits for European businesses. The agreement would remove tariffs on 91% of EU exports to the Mercosur countries and 92% of imports into the EU. This could generate around €4 billion in annual tariff savings.

However, the overall economic impact for the EU is expected to be limited. European Commission estimates suggest the agreement would add only 0.05% to the EU economy by 2040, or about €90.2 billion. This reflects relatively low trade volumes between Europe and South America, even with Brazil as the largest Mercosur economy.

For the Mercosur countries, the impact is likely to be stronger. Economists expect higher export growth and more direct economic gains. While the EU often presents the deal as part of its broader EU trade policy and a response to US-China competition, the South American trade bloc may see clearer short-term benefits.

https://epthinktank.eu/2019/12/11/mercosur-economic-indicators-and-trade-with-eu

Which B2B Sectors Stand to Gain or Lose

The impact of the EU-Mercosur trade deal will not be the same for all industries. Some B2B sectors could benefit from lower tariffs and better market access, while others may face stronger competition.

Sectors likely to benefit

- Automotive companies: Lower automotive tariffs could reduce costs and improve export competitiveness

- Pharmaceutical exports: Easier access to Mercosur markets

- Industrial machinery: New sales opportunities across the South American trade bloc

Sectors more exposed to risk

- Agriculture: Stronger competition from lower-cost imports

- Food processing: Pressure on prices and margins

Sectors with mixed impact

- Logistics and ports: Higher trade volumes but more checks and uncertainty

- Distributors: More sourcing options, alongside higher commercial and regulatory risk

https://ec.europa.eu/eurostat/web/products-eurostat-news/-/ddn-20221026-2

Farmers Remain Firmly Opposed

European farmers protests remain a major source of opposition to the EU-Mercosur trade agreement. Farming groups argue that higher imports from the Mercosur countries would increase competition and put pressure on EU producers.

Concerns focus on beef and poultry quotas and on Brazilian exports that are often cheaper than EU products. Farmers also highlight differences in production standards.

The European Commission has proposed safeguard measures such as import controls and crisis support. However, these steps have not eased opposition and continue to affect the approval process.

Regulatory Differences Still Matter for B2B Trade

For EU B2B companies, lower tariffs do not remove regulatory challenges. Even if the EU-Mercosur trade agreement is approved, compliance will remain a key issue.

Main risks for B2B businesses include:

- Different standards: Environmental, food safety, and production rules differ between the EU and the Mercosur countries.

- Ongoing compliance costs: EU importers must still meet EU rules, which adds checks, paperwork, and costs.

- Tighter controls: Lower tariffs may come with stricter inspections at EU borders.

- Possible use of safeguard measures: Safeguard measures can limit imports and disrupt supply chains with little warning.

With regulatory conditions still unclear, large organisations are taking a more cautious approach to sourcing, and this caution is felt across the supply chain. Partner selection is tightening, with requests for quotes increasingly used to test pricing, compliance, and delivery terms before any long-term commitment is made.

Strategic Stakes Continue to Rise

The timing of the EU-Mercosur trade agreement makes the debate more important. Global trade is becoming more divided, with higher political risk and stronger competition between major economies. In this context, the EU sees the agreement to protect its long-term trade position.

China’s growing role in South America is a key concern. China now buys around 30% of Brazilian exports, while the EU accounts for about 16%. This shift shows how influence in the region is changing and why the EU wants stronger ties with the Mercosur countries and the wider South American trade bloc.

Because of this, the EU-Mercosur trade deal is increasingly seen as a strategic move, not just an economic one. Supporters argue that it could help secure supply chains, support exporters, and strengthen EU trade policy at a time of rising US-China competition. Critics, however, question whether these long-term goals justify the political and social challenges linked to the deal.

Conclusion

The EU-Mercosur trade deal has the potential to change trade between Europe and the Mercosur countries, but it is not yet a reliable basis for business decisions.

Until parliamentary approval and national ratification are secured, B2B companies should plan around current tariffs and rules, test opportunities cautiously, and avoid rigid commitments. The opportunity is real, but timing remains the key risk.

For more insights on EU trade developments and how B2B companies can prepare for regulatory and compliance changes, europages Inside Business offers practical guidance and analysis.

- German Supply Chain Act | Europages

- Valentine’s Day in Europe: A €3+ Billion B2B Opportunity

- Why UK Vehicle Production Targets Matter for B2B Suppliers