Table of Contents

- Challenges for Europe’s B2B Logistics System and European Suppliers

- How to Avoid Lead-Time Issues in the Request for Quotation Cycle

- What Strains Logistics in the B2B Marketplace

- Inventory Management Challenges and Christmas Delivery Pressures

- Rising Logistics Costs for Companies Working With International Suppliers

- Managing Delivery Slowdowns That Impact the Request for Quote Process

- How Poor Visibility Weakens Supply Chains and Supplier Database Accuracy

- Seasonal Capacity Limits Driven by Christmas Wrapping Paper Demand

- The Future of Modern Sourcing Platforms

Challenges for Europe’s B2B Logistics System and European Suppliers

Every year, the lead-up to Christmas challenges European B2B supply chains. Rising seasonal demand forces suppliers to accelerate production, plan deliveries carefully, and manage logistics pressures across international and domestic networks.

During the holiday season, almost every part of Europe’s logistics network comes under pressure, with several challenges often happening at the same time. Here are the main issues supply chain teams are facing:

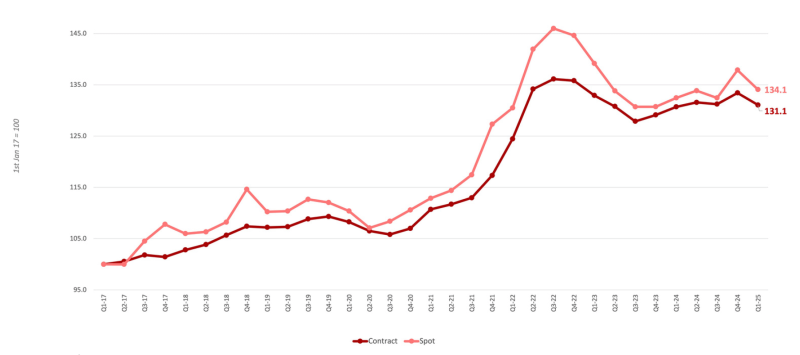

- Seasonal demand surges. Eurostat reports that EU road freight transport volumes rose from 1,848 billion tonne-kilometres in 2023 to 1,869 billion in 2024, while capacity in trucking, rail and maritime transport expanded at a slower rate. As of late 2025, early‑quarter data and industry‑level indicators suggest a moderation in freight‑transport demand across Europe. According to a report from the International Road Transport Union (IRU), the European road‑freight contract‑rate index fell in the first quarter of 2025 compared to Q4 2024, while spot‑rates also declined, pointing to a softening in transport demand at the start of the year. Also, national‑level reporting for Spain, one of the EU’s major road‑freight markets, indicates that road‑transported cargo tonnage in the third quarter of 2025 dropped roughly 3 % year‑on‑year, suggesting domestic demand may be slowing. These signals suggest that demand growth in early 2025 is slowing down instead of continuing the strong rise seen in previous years.

European road freight contract rates in Q1 2025 (Source: Upply).

- Weather-related disruptions. Snow in Central Europe and storms in the North Sea region often cause transport delays. European transport monitoring agencies report that during some winters; average road transit times are 2 to 3 % longer than usual. Supply chain managers have a short time of response, as the margin for error in December is much smaller, particularly for international suppliers.

- Labour shortages in critical roles. According to OECD, in 2024–2025, Europe faced significant truck‑driver shortages, with Germany short around 70,000 drivers, and recruitment difficulties reported by up to 70% of trucking companies.

- Rising fuel and energy costs. Eurostat reports that average industrial electricity prices in the EU are about 25% higher than in 2020, raising production and packaging costs for machinery-intensive suppliers. Meeting sustainability requirements also means more documentation and new investments, which adds further financial pressure for many European suppliers.

- Port and rail congestion at major hubs.In December, the ports of Antwerp, Rotterdam, and Hamburg often operate near full capacity, leading to delays and rerouted shipments. Rail networks face similar problems, as winter conditions reduce reliability and slow operations.

- Digitalisation gaps across suppliers and carriers. Some European supply chains now use real-time tracking and automated documentation, while others still depend on manual communication. This inconsistency makes visibility and planning harder, especially when sourcing and RFQs are managed across different systems.

- Volatile inventory behaviours. Companies adjust their inventory strategies in unpredictable ways and at the last minute. Some build up stock early, while others delay orders to preserve liquidity. This volatility makes planning more difficult for suppliers and wholesalers.

How to Avoid Lead-Time Issues in the Request for Quotation Cycle

To start with, a clear and detailed quotation request (RFQ) process helps maintain smooth communication.

According to the World Economic Forum , real-time information sharing between buyers and carriers improves visibility and traceability, which in turn helps reduce delays and inefficiencies in supply-chain operations.

Also, predictive analytics are making lead time estimates more reliable. For example, many German manufacturers now use last December’s routing data together with basic machine learning to spot possible bottlenecks before they happen.

Meanwhile, French distributors rely on digital alerts that flag delays in real time so they can quickly adjust their fulfilment plans.

What Strains Logistics in the B2B Marketplace

Europe’s logistics system faces two persistent issues: labour gaps and transport capacity shortage across multiple modes. These constraints influence B2B operations and affect both European suppliers and international suppliers shipping across borders.

The following sections outline the key pressure points currently driving logistics performance, drawing on the latest publicly available data.

Where Labour Gaps Are Most Severe in EU Logistics

- Germany continues to face one of the most acute truck driver shortages in Europe.

- Poland reports a strong demand for additional freight operators.

- In France, warehousing roles remain difficult to fill, particularly for December shifts.

- Across Southern Europe, companies struggle to recruit workers for specialised cross-docking and port-handling positions.

These labour shortages slow down throughput, lengthen loading times and weaken the overall resilience of Europe’s supply chain during peak seasons.

How Capacity Shortages Impact Cross Border Transport Efficiency

Limited vehicle availability often forces carriers to combine shipments. When demand rises, they tend to prioritise high-volume clients, leaving smaller suppliers with fewer transport options.

According to Eurostat, cross-border transit times rose by more than 8% during the last holiday peak, with the biggest delays on routes between Germany and France, and Germany and Italy.

For packaging manufacturers that depend on just-in-time deliveries, late arrivals can disrupt production schedules. Ongoing capacity shortages also push more suppliers to use premium shipping services, driving up costs across the entire supply chain.

Inventory Management Challenges and Christmas Delivery Pressures

Eurostat reports that inventory volatility rises sharply in the 4th quarter across Germany, France and the Benelux region. Planning becomes particularly difficult for

- suppliers of Christmas wrapping paper,

- retailers preparing Christmas clearance sales,

- wholesalers handling large volumes of Xmas decorations and

- packaging producers delivering sets for Christmas Eve box campaigns.

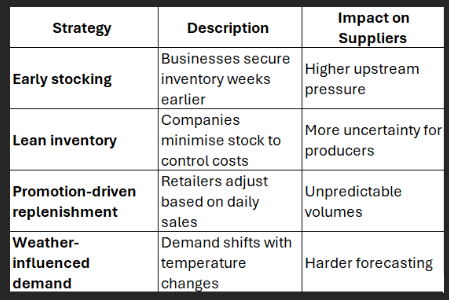

Inventory Behaviours During the Holiday Season

The table below summarises how different inventory behaviours during the holiday season influence suppliers across the value chain.

Sector Specific Inventory Risks During the Holidays

- Electronics suppliers often experience sudden demand spikes that quickly alter their packaging needs.

- Fast-moving consumer goods companies (FMCG) companies rely on fast replenishment cycles that only work when warehouse capacity remains stable.

- For packaging manufacturers, production runs have to be scheduled weeks in advance, since once the holiday rush begins, it’s nearly impossible to change designs or adjust finishing lines.

A Case Study of a Data Driven Peak Season Inventory Strategy

Carrefour has invested heavily in digital supply-chain tools. In Italy the company has rolled out a forecasting and replenishment platform across its roughly 1,200 stores and seven logistics hubs, aiming to reduce manual processes and increase supply-chain visibility.

This data-driven approach helps Carrefour respond more quickly to changes in demand, improve product availability, reduce waste and overstock and stabilise supply flows even during busy periods.

Rising Logistics Costs for Companies Working With International Suppliers

Fuel and energy prices remain volatile. As diesel becomes more expensive, long-haul road transport gets costlier for carriers. At the same time, rising electricity prices increase the day-to-day running costs of warehouses, including cooling, heating and automated systems.

Below, several key cost drivers explain why logistics expenses continue to rise across Europe.

Fuel and Energy Price Trends Affecting European Logistics

Energy-intensive operations such as packaging printing or cold storage become more expensive when electricity prices rise.

Logistics hubs in Germany and France report persistent pressure from higher heating and automation-related energy costs.

Also, Carriers often apply surcharges that change monthly, complicating long term budgeting.

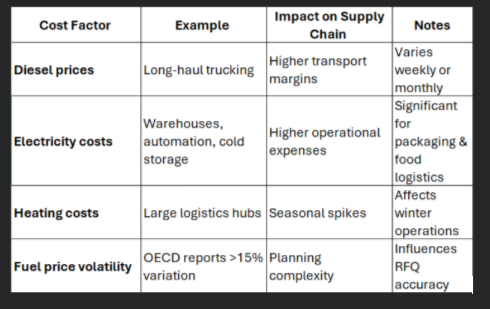

Cost Drivers Impacting European Logistics

The table below outlines key cost drivers currently affecting European logistics and the implications they create for supply chain operations.

The Financial Impact of EU Sustainability Regulations on Suppliers

New sustainability rules now require companies to track emissions accurately. To comply, many companies are introducing new monitoring systems, calculating emissions for each transport mode and verifying all related documentation.

To learn more about sustainability reporting rules, read our article about Understanding the Corporate Sustainability Due Diligence Directive (CSDDD) and its Impact on Businesses

According to the European Commission, small and mid-sized logistics firms may see administrative costs rise by up to 10% as they adapt to new requirements. But those that adopt digital compliance tools early typically experience a smoother transition, clearer communication and fewer delays during busy shipping periods.

Managing Delivery Slowdowns That Impact the Request for Quote Process

Every Christmas season brings familiar challenges. Congestion at ports like Antwerp, Marseille, Rotterdam and Hamburg slows incoming freight, while traffic in Germany’s industrial hubs can stall outbound moves. Companies that spread their shipments across different transport modes usually handle these disruptions far better.

Strategies Used by High Performance Logistics Hubs

Leading hubs use predictive modelling, flexible staffing and extended operating hours. For example,

- Rotterdam employs digital twins to forecast congestion.

- Hamburg increases throughput with automated crane systems and intelligent yard management.

These hubs are able to process high volumes during December because they integrate automation, planning and real time data from carriers.

Real Examples of Rerouting and Multi Modal Solutions

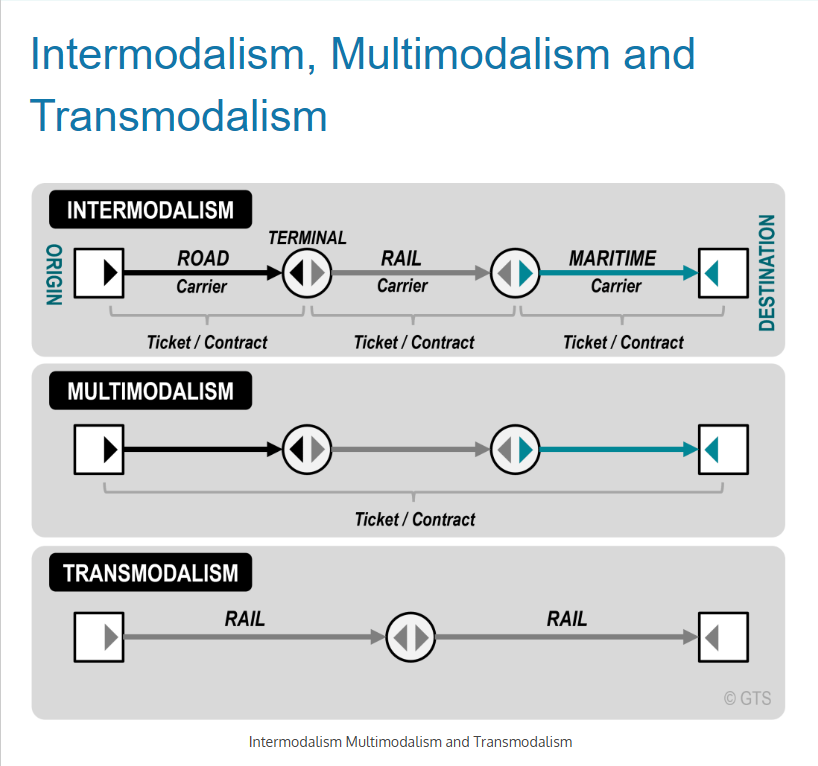

As multimodal transport expands across Europe, more companies are combining rail and road transport to manage seasonal demand peaks, reduce bottlenecks, and maintain consistent supply flows even under pressure.

Source: The Geography of Transport Systems

According to the latest UIRR report, intermodal freight in Europe grew in 2024, with shipments up 5% and tonne-kilometres up over 8%, led by strong demand in France and Poland. More companies are using rail–road combinations to ensure reliable deliveries and avoid delays.

For example, Decathlon has strengthened its European logistics network by using more rail and intermodal transport, which helps improve reliability and reduce emissions between fulfilment centres and regional warehouses.

How Poor Visibility Weakens Supply Chains and Supplier Database Accuracy

Especially during the holiday season or year-end peak, when supplier information is outdated or systems are not well connected, delays become much harder to anticipate. Gaps in data affect product availability, push companies to carry more buffer stock and make it harder to respond quickly when disruptions occur.

The sections below outline the most common visibility failures and how leading suppliers address them.

Where Seasonal Volume Peaks Tighten Capacity Across Europe

As the festive season gets closer, pressure builds across the supply chain. Companies preparing Christmas deliveries, retailers planning post-holiday sales, organisers setting up Christmas markets and manufacturers shipping seasonal packaging all tend to see capacity tighten sooner than expected.

The following overview looks at how these seasonal peaks affect different sectors and regions, showing where bottlenecks are most likely.

Seasonal Capacity Limits Driven by Christmas Wrapping Paper Demand

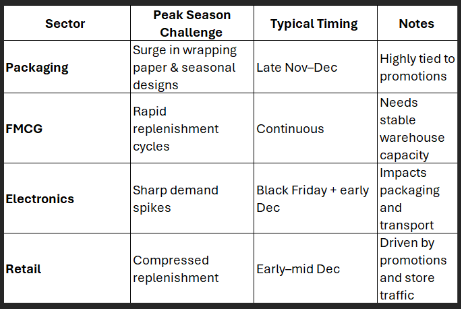

During the holiday season, demand for certain products creates seasonal capacity limits across Europe. Packaging sees a surge in wrapping paper and seasonal designs from late November to December, while electronics experience sharp spikes around Black Friday and early December. Retail and FMCG sectors face compressed replenishment cycles that put pressure on warehouses and transport. Some countries are more affected than others.

The table below highlights how holiday demand patterns differ by sector and when pressure typically peaks.

The Future of Modern Sourcing Platforms

European supply chains are evolving fast. Operations are running smoother and more accurately than ever, as robotics and AI bring precision and smarter forecasting to every step.

Technologies once seen as futuristic, like drone deliveries and autonomous transport routes, are beginning to show what’s possible, especially during peak seasons. With time, logistics will become faster, more resilient, and ready for the challenges ahead.

Trends and Smart Fulfilment Technologies for B2B Sourcing

Many companies are using digital twins to plan warehouse layouts. A digital twin is a virtual replica of a physical object, process, or system. It can simulate a warehouse, a transport network, or even an entire supply chain. It allows companies to test changes, identify potential problems, and optimize operations without disrupting the real-world system.

For example, a warehouse digital twin can show how different layouts affect workflow, how adding robots changes picking times, or how seasonal demand impacts storage and shipping. Companies can run “what-if” scenarios in the digital model to make smarter, faster decisions in real life.

Their adoption is growing in Germany, France, and the Nordic countries as supply chains seek smarter ways to manage peak demand.

Predictions Based on Current Market Research

Across Europe, AI-driven planning is accelerating, as highlighted by the OECD studies.

Eurostat’s 2025 digitalisation report shows that about 74% of EU companies have achieved a basic level of digital intensity, with the EU aiming for over 90% of SMEs to get there by 2030.

As digital adoption grows, sourcing platforms are likely to take on a much wider role than they currently do.

Beyond integrating supplier data, automating RFQs and simplifying cross-border planning, they will connect inventory signals with transport availability, detect early congestion and recommend alternative routes or carriers in real time.

As more supply chain partners begin to share data, planning will become smoother, operations more resilient and peak-season risks far easier to manage.

Conclusion

The holiday season magnifies every weakness in European supply chains. Firms that invest in clearer visibility, smarter forecasting, multimodal planning and stronger supplier ties usually handle the Christmas peak with fewer disruptions.

As logistics in Europe keeps changing, the future promises smoother operations, better service, and greater resilience for those ready to embrace the changes.

Read more about sourcing trends, peak-season logistics and European supplier strategies at Inside Business: the B2B blog from europages.

- Ho-Ho-Hold the Delays: Tackling Delivery Challenges with Innovation in the Holiday Shopping Season

- Agile procurement organisations: the best response to procurement risks

- Does TikTok Now Decide What Fills Supermarket Shelves?