Table of Content

- What Is White Hydrogen?

- The French Discovery

- Why Industry Should Be Paying Attention to White Hydrogen?

- France Might Be First, But Are Others Catching Up?

- Still Some Big Questions to Answer

1. What Is White Hydrogen?

White hydrogen is molecular hydrogen (H₂) that forms naturally underground through geological processes like serpentinization or radiolysis. It accumulates deep beneath the Earth’s surface in reservoirs, much like oil or natural gas, and could be extracted without major emissions.

This discovery could reshape Europe’s industrial energy supply, especially sectors like transport, heavy industry and manufacturing, which are struggling to decarbonize without sacrificing performance or profit.

What makes it so exciting is how it stacks up against other types of hydrogen:

| Type | How It’s Made | CO₂ Emissions | Market Share |

Grey |

From methane |

High |

~48% |

Blue |

From methane + carbon capture |

Medium |

~22% |

Green |

From water using renewable electricity |

Low (if clean-powered) |

~1% |

White |

Formed naturally underground |

Zero |

<0.1% |

White hydrogen doesn’t need electrolysers or carbon capture systems. Its extraction could cost as little as €0.5 to €1.5 per kilogram to extract. That’s significantly cheaper than green hydrogen, which runs around €4 to €6/kg depending on electricity costs.

2. The French Discovery

The first signs appeared in 2023 during methane exploration in northeastern France. At around 1,250 meters deep, researchers found unusually high hydrogen levels (up to 20%) in a well originally drilled for gas, leading France’s CNRS (National Centre for Scientific Research) and BRGM (Geological and Mining Research Bureau) to launch further investigations.

In May 2025, scientists confirmed the existence of another major underground hydrogen reserve in eastern France, the world’s largest to date. This second site further validates the region’s geological potential and reinforces France’s position at the forefront the field.

The reserve could hold up to 250 million tons of white hydrogen; a volume large enough to meet global demand for two to three years. At an estimated value of €2 per kilogram, this represents €500 billion in economic potential. For context: the entire world currently produces around 95 million tons of hydrogen annually, mostly from fossil fuels.

Key facts at a glance

| Feature | Details |

Initial Discovery |

2023, during methane drilling in France |

Depth of Deposit |

~1,250 meters |

Hydrogen Concentration |

Up to 20% |

Institutions Involved |

CNRS, BRGM |

Estimated Volume |

250 million tons |

Potential Value |

~€500 billion (at €2/kg) |

World Hydrogen Demand (2025) |

~95 million tons per year (mostly fossil-based) |

Major Update |

May 2025: Confirmed largest white hydrogen deposit in Lorraine |

Location |

Lorraine Basin, northeastern France |

CO₂ Emissions |

None (naturally occurring, clean at use) |

Estimated Cost |

€0.5–1.5 per kg |

Main Applications |

Energy, Transport, Manufacturing |

Global Impact |

Could meet 2–3 years of current global hydrogen demand |

Pilot Phase Timeline |

Expected to begin between 2027 and 2028 |

3. Why Industry Should Be Paying Attention to white hydrogen?

White hydrogen is potentially a major opportunity for industries looking for scalable, low-emission energy sources.

- In the energy sector, it could be used in hydrogen turbines for power generation or stored for later use, especially during peak energy demand.

- For transport and logistics, it is a viable fuel for hydrogen-powered trucks, trains, and ships where batteries often fall short.

- In heavy industry, it could be a clean alternative for high-emission processes like steelmaking, ammonia production, and cement manufacturing.

- It helps reduce both emissions and energy costs, without compromising performance or reliability.

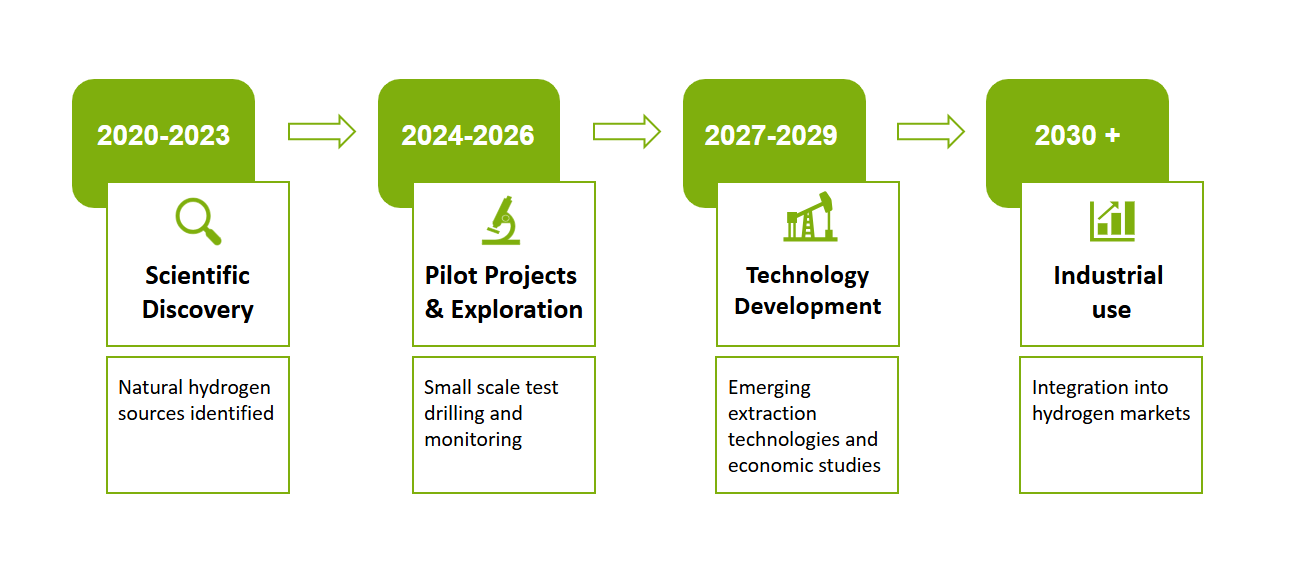

The timeline below outlines the key stages in its path from scientific curiosity to large-scale use.

White hydrogen has real potential for sectors like transport fleets, industrial gases, process heat, and hydrogen logistics. Strategic partnerships will pay off as the market develops.

4. France Might Be First, But Are Others Catching Up?

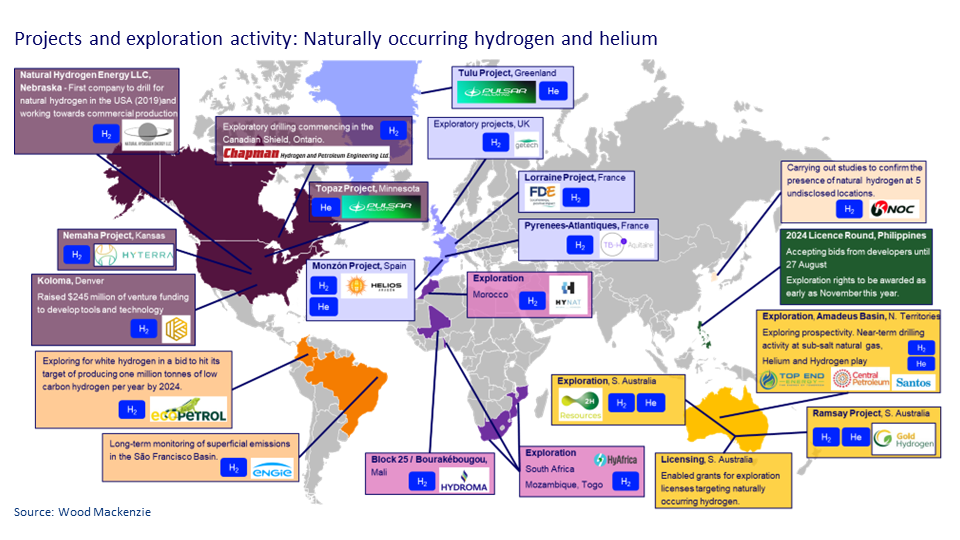

France may have struck first, but countries like Australia, the United States, and Slovakia are already exploring their own underground hydrogen reserves.

In the U.S., surveys are underway in Nebraska and the Appalachian Basin, while Australia is drilling in remote areas of Western Australia. Eastern European countries are getting involved, although Germany sees limited potential due to its geology.

France is expected to lead on this front. The government and EU institutions are already talking about fast-tracking new rules to support white hydrogen exploration and extraction.

Project and exploration activity: Naturally occuring hydrogen and helium

5. Still Some Big Questions to Answer

While the discovery is promising, several important questions remain unanswered.

- Extractability: Not all underground hydrogen can be recovered. Reservoir pressure, permeability, and flow dynamics will determine long-term viability.

- Impact on local geology: How will long-term hydrogen extraction affect underground rock formations? Is there a potential for induced seismic events similar to those seen in gas extraction?

- Risk of groundwater contamination: Could drilling operations disrupt or pollute nearby aquifers?

- Public response: How will communities react if hydrogen projects move closer to residential or protected areas?

- Regulatory gaps: France doesn’t yet have a dedicated hydrogen mining code, meaning new laws and oversight structures will be needed before large-scale extraction can move forward.

Final Thoughts

As momentum builds around green hydrogen and renewable solutions, white hydrogen emerges as a natural and clean alternative. Its long-term viability still remains uncertain, but the potential is hard to ignore.

Interested in learning more about energy and clean technologies? Read these articles from europages blog Inside Business :

Supercritical CO2, a New Promise of Effective Recycling

Stop Being Nice to AI: It’s Burning Cash and Carbon

How the Manufacturer of Heat Pumps Can Drive Industrial Decarbonization in the EU