Focus points

- What is the EU Green Deal?

- The Data Behind the Change

- Europe’s Sustainability Strategy for Polymers and Plastics

What is the EU Green Deal?

The European Green Deal is the EU’s plan to go climate neutral by 2050. A big part of it is the Circular Economy Action Plan, which focuses on cutting waste, making products last longer, and keeping materials in use through recycling.

It's Impact on Injection Molders

The big shift for plastics is the new Packaging and Packaging Waste Regulation (PPWR), in force since February 2025. It sets mandatory recycled content targets and tougher rules on how recyclable plastic packaging must be.

Recycled Content Targets: By 2030, certain types of plastic packaging must contain a minimum level of recycled material. This requirement forces manufacturers to source polymers with proven recycled inputs.

Design for Recycling: New products must be designed to be easily recyclable, eliminating hard-to-process composites and multi-layered plastics.

Ban on Certain Single-Use Plastics: The EU has already phased out straws, cutlery, and other single-use plastics, and the new rules expand this principle.

For injection molders, these rules shift the conversation from “what is cheapest?” to “what is compliant and sustainable?” Material selection now determines not just production costs but also whether your company can legally market its products within the EU.

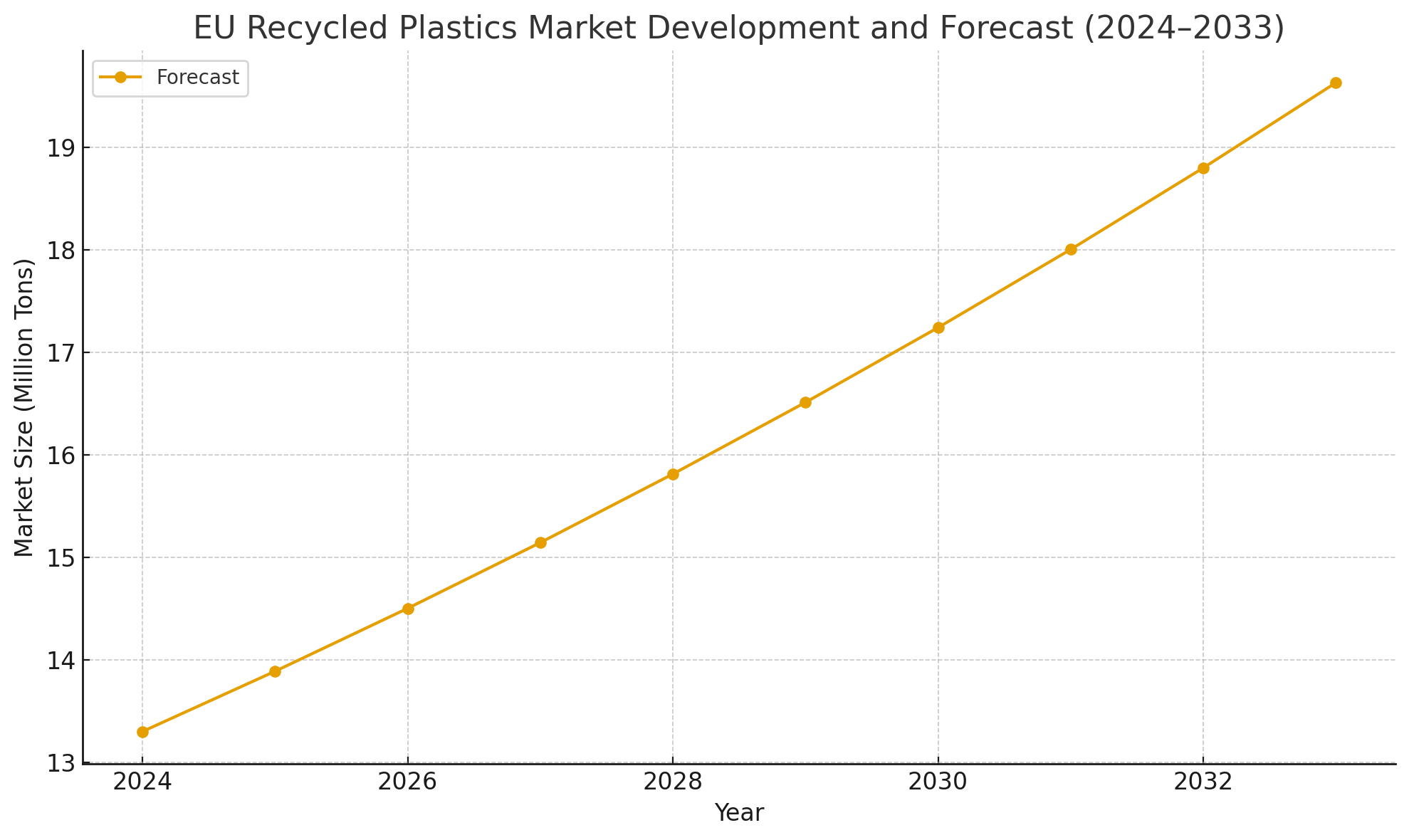

The Data Behind the Change

The EU’s recycled plastics market was valued at 13.3 million tons in 2024 and is projected to grow at a CAGR of 4.42% between 2025 and 2033.

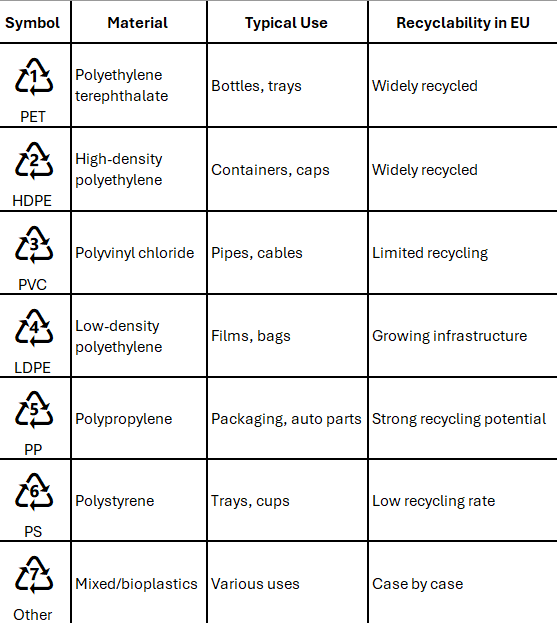

Plastics Resin Identification Codes

Europe’s Sustainability Strategy for Polymers and Plastics

While the EU sets the framework, each country interprets and implements these rules differently, creating a patchwork of market realities for polymer and plastics. Understanding these differences is crucial for cross-border B2B partnerships and sourcing strategies.

Germany

Germany operates one of the most robust “Extended Producer Responsibility” (EPR) systems in Europe. Polypropylene (PP) and polyethylene (PE) remain dominant polymers thanks to their adaptability and compatibility with the country’s well-developed recycling system. In 2022, Germany achieved a 51.1% recycling rate for plastic packaging, one of the highest in Europe. For injection molders, this means strong availability of high-quality recyclates.

France

France’s “AGEC law” sets the tone for sustainability. Consumers increasingly demand circular materials, and the government has backed this up with bans on single-use plastics. While PP and PE are still widely used, the momentum is shifting toward recycled and bio-based polymers. However, the country’s recycling rate remains low at 25.2% for plastic packaging in 2022, which means supply chains for recyclates are still developing.

Italy

As a major plastics processor, Italy has a strong reliance on polyolefins like PE and PP, particularly in packaging and automotive. Italian companies are investing in advanced recycling technologies, from chemical recycling to improved sorting facilities. These investments will soon increase both the availability and quality of recycled polymers for B2B buyers.

Nordic Countries (e.g., Sweden)

The Nordics have built a reputation as sustainability frontrunners. Alongside conventional polymers, there is a growing market for bio-based and wood-based composites. Driven by consumer awareness and carbon reduction policies, companies here are experimenting with next-generation materials that replace fossil-based plastics altogether.

Spain

Spain has intensified efforts to align with EU recycling targets, particularly after lagging in past years. The Spanish market is pushing hard to expand the use of recycled PET (rPET) in packaging. With strong demand in the food and beverage sector, Spanish injection molders increasingly seek suppliers that can guarantee certified recycled inputs.

United Kingdom

The UK is following a parallel trajectory. Its Plastic Packaging Tax, introduced in 2022, requires packaging to contain at least 30% recycled plastic. This regulation has accelerated the adoption of recycled PP and PET. For European suppliers, the UK remains a vital export market with its own distinct compliance requirements.

Checklist for Choosing the Right Polymer

Choosing the right polymer is no longer a matter of simply comparing resin prices. Instead, companies must evaluate a wider set of technical, regulatory and reputational factors.

Here is a practical checklist to guide sourcing decisions:

- Regulatory Compliance: Does the material meet EU requirements for recycled content and recyclability?

- Certification: Is the polymer certified by recognized European or global standards?

- Traceability: Can the material’s recycled or bio-based origin be traced?

- Supply Chain Stability: Is there a reliable supply of this polymer in your region?

- Performance: Does it meet durability and functional requirements for your product?

- Processing Efficiency: Is it compatible with existing injection molding equipment?

- Recyclability Post-Use: Will the end product be easy to recycle in European facilities?

- Cost Predictability: Are price fluctuations manageable compared to alternatives?

- Market Advantage: Can using this polymer be a selling point with retailers and end-users?

- Future Readiness: Will this material still be compliant with expected 2030 targets?

This framework encourages businesses to think beyond short-term savings and invest in long-term resilience.

Conclusion

Injection molding is no longer defined by volume alone. It now means delivering products that are sustainable and aligned with Europe’s evolving standards.

For more insights, visit Inside Business, the europages blog, where you can explore additional articles on material selection, polymer innovation and plastic recycling efficiency.